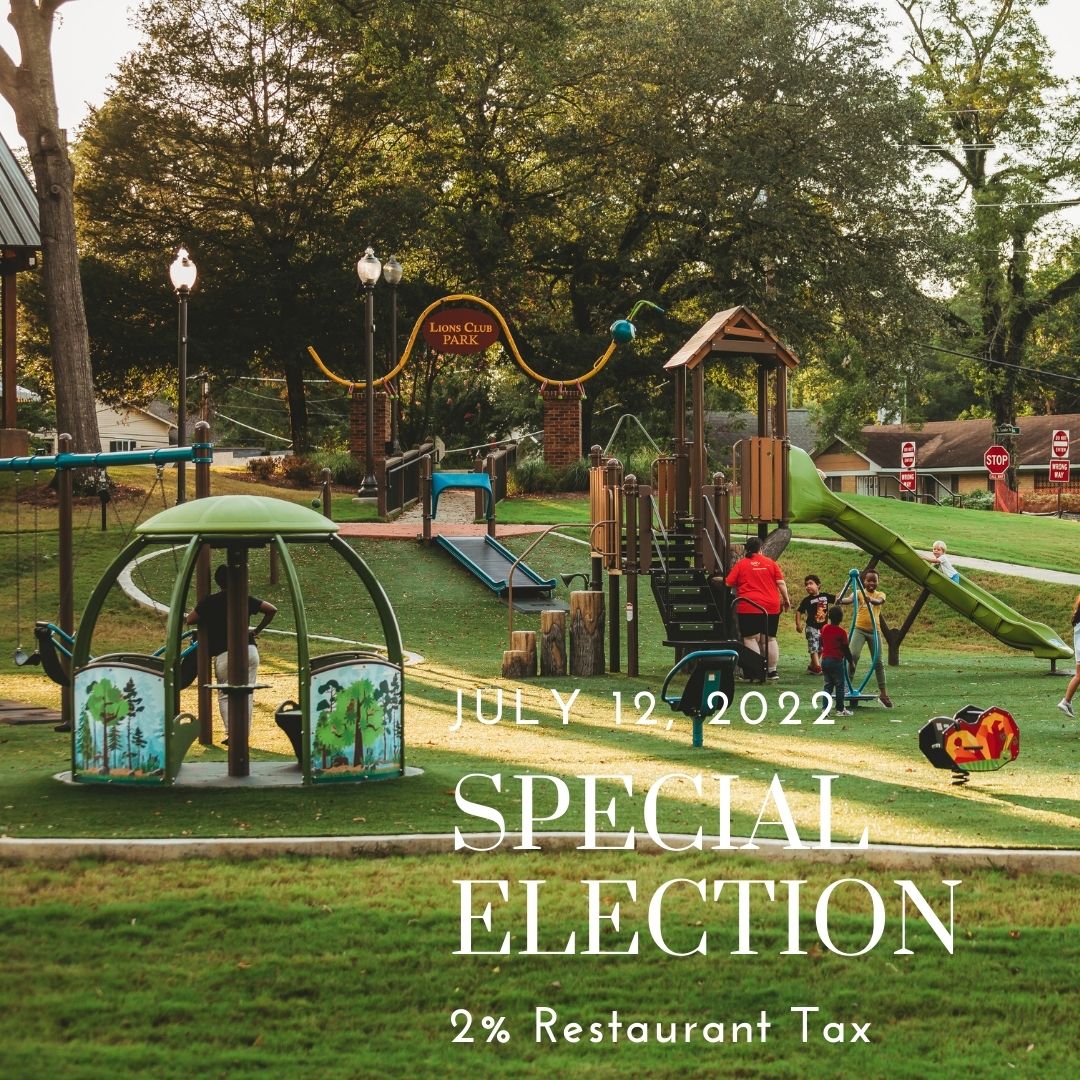

2% Restaurant Tax

2% Restaurant Tax Increase

2022 Special Election

July 12, 2022

7 AM to 7 PM

Traceway Park, 200 Soccer Row, Clinton, MS 39056

Facts and Answers

1. Why have an additional 2% added to the 7% restaurant tax? Citizens are asking for quality of life and recreational activities that the City of Clinton budget cannot afford due to other pressing objectives such as public safety and infrastructure. Other cities are feeling the same pressure. Increasing the restaurant tax by 2% should generate approximately $1,000,000 a year, allowing Clinton to keep up with the other communities that are already using their restaurant tax for these Parks and Recreation improvements.

2. What is the process to get to vote on this issue? The City had to request Legislative approval to hold a vote of the people. That was requested and granted in this past legislative session. The next step is for the City of Clinton to hold a vote on whether or not you want 2% added to your restaurant tax (increasing from 7% to 9 %). It must be passed with a 60% majority and must be re-voted every four years to remain in effect. Reapproving the additional 2% tax every four years assures that the intended use of the money raised is not changed. If it is not used as agreed upon by the vote, you can vote the increase out.

3. Will the 2% tax apply to the purchase outside of restaurant food? No, the additional 2% is only for meals purchased from restaurants in Clinton. The sales tax for groceries, clothing, and other goods will remain at 7%.

4. What does this increase represent on a $35.00 restaurant bill? $35.00 X 7% = a $2.45 tax, 35.00 X 9% = 3.15 tax. The difference between $2.45 and $3.15 is 70 cents.

5. How much money will this raise? A 2020 estimate indicated a 2% tax on restaurant food (only) will raise approximately $1,000,000 annually.

6. Will the City use this money to apply for grants? Yes, most grants require a 50% match. Using the entire $1,000,000 as a match for various projects will double the money to $2,000,000 per year.

7. What if the money does not come to $1,000,000 at the end of a year? To be safe, we will wait a year before spending anything to assure we know the correct amount. Then, we will begin the grant process to double the amount collected from the 2%. While we are collecting the additional 2% money during the first year, we will be meeting with groups of interested citizens for community input. This process will determine the types of projects we will construct.

8. How many cities already have this restaurant tax? 90 Mississippi cities have a restaurant tax that goes towards their Parks and Recreation department.

9. What type of projects could be constructed? Improving existing facilities and fields, creating walking and biking trails, purchasing new playground equipment, improving lighting at fields and parks, improving or building bathrooms and pavilions, constructing new or improving existing concession stands, adding more tennis and pickleball courts, and many more things.

10. Will the 2% increase go to the construction of the new 84 acres Clinton acquired? No, the concept for the 84-acre park has not been determined yet and design will take a few years. Perhaps, in the next vote in four years, but not in the first four years.